Bitcoin is dropping again, and the recession doesn’t seem to stop against the proprietary cryptocurrency. It has finished the last eight weeks in losses and appears ready to continue the rut. There is good reason why extremists are afraid of their beloved Bitcoin dropping below new support levels.

someday! someday!

It is currently trading at $28,800, but is down about 1% in the past 24 hours. Due to the lack of movement lately, Bitcoin is now expected to end the week around the $29,000 region. Volume is another factor of concern as it is down nearly 25% since yesterday.

The biggest cryptocurrency went through extreme volatility this month with Terra’s disengagement dashing hopes of any recovery. Billions have been wiped out from the cryptocurrency market after the crash that put Bitcoin on the brink of a major crash.

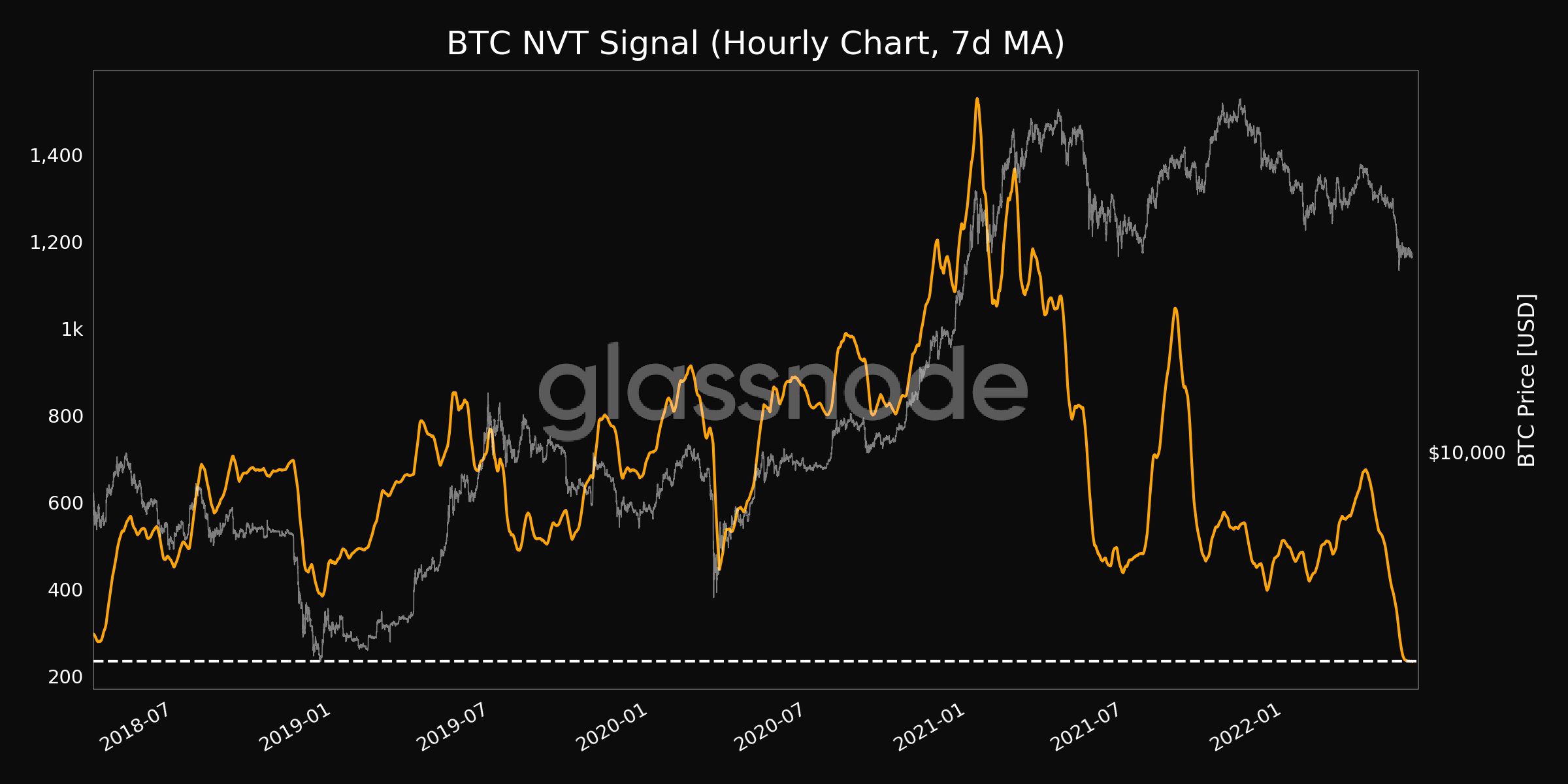

Bitcoin survived but consolidated around the $29,000-$30,000 region. However, the metrics suggest there is still more to come with the recent data that is not encouraging. In a recent Glassnode tweet, the NVT signal was at a 4-year low of 233.9. In fact, the previous 4-year low was observed as recently as May 25th which added to the pressure on the Bitcoin community.

Another tweet raised eyebrows across the crypto space, with Crypto Quant stating that there will be, “2-3 months of boring price action. Then another possible capitulation with an additional 30%-50% price drop.” This confirms the market bottom is being explored through the Bitcoin price chart as it struggles to rise back above the $30K level.

Analyst Gives Bitcoin Great Hope

Marion Laboure, an analyst at Deutsche Bank Research, said in a statement: an interview With CNBC,

“Bitcoin will continue to rise in value based on what people think it is worth.”

Bitcoin is positioned in the red chart a lot these days as it looks to finish its ninth consecutive loss. It’s also less than half its highest ever value of about $68,000. But Labory mentioned four factors that will eventually help Bitcoin achieve victory.

Labore presents four factors that can lead to an increase in the price of Bitcoin. The first factor is the psychology behind bitcoin and the cryptocurrency it refers to as the Tinkerbell effect. This means that market sentiment towards Bitcoin will determine its future growth.

about 55% of BTC dollars Offer is still in profit

“2-3 months of boring price action. Then another possible capitulation with an additional 30%-50% price drop.”

by Tweet embedRead more👇https://t.co/BTolS8aBEt pic.twitter.com/GQcPojIzXC

– CryptoQuant.com (cryptoquant_com) May 27 2022

The second factor is supply and demand. With a constant supply of 21 million coins, the demand for Bitcoin will eventually increase which will drive prices up. The third factor is the most controversial: regulation. She also stated that she had reason to believe that “regulation is coming” which could pave the way for greater adoption of cryptocurrencies.

Finally, she cited volatility as a factor in determining Bitcoin’s growth. Cryptocurrency markets have been plagued by volatility in recent years with the Terra crash being the latest example. But with regulations and increased adoption, volatility can actually play in Bitcoin’s favour.

“Twitter practitioner. Beer evangelist. Freelance gamer. Introvert. Bacon aficionado. Webaholic.”

![Bitcoin [BTC] Chances of a short-term recovery look bleak thanks to… Bitcoin [BTC] Chances of a short-term recovery look bleak thanks to…](https://osoyoostoday.ca/wp-content/uploads/2022/05/Bitcoin-BTC-Chances-of-a-short-term-recovery-look-bleak-thanks.jpg)

More Stories

Asian stocks slide as Fed hike fears push Wall Street into a bear market

Dow Jones plunges 900 points, S&P enters bear market as inflation fears escalate

Bitcoin Price: Percentage Trading Paused, Binance Pausing Some Withdrawals