He wrote: “McDonald’s board of directors … is failing shareholders and stakeholders by overseeing animal welfare abuses, supply chain downfalls and what I see as a hollow Environmental, Social, and Governance (ESG) agenda.” “The company’s reluctance to improve policies and verification methods presents a serious risk to the business, its bottom line, and the world around us.”

Icahn said he only owned 200 shares in the company, McDonald’s indicated at the time.

“While the company looks to foster further collaboration across the industry on this issue, the current supply of pork in the United States will make this type of commitment impossible,” McDonald’s said.

The letter set out clear demands, including a commitment to remove the use of carry-on boxes entirely from McDonald’s supply chain by the end of next year, among other things.

The company said in a statement in response to the filings that making the changes requested by Icahn will increase prices for customers.

“McDonald’s today is paying a premium to purchase mass pork in accordance with our 2012 commitment,” the company said, noting that switching to a system that meets the standards set by Icahn Thursday “would significantly increase these costs, placing a burden on all aspects of our business, supply chain, and McDonald’s customers.” “.

From the company’s point of view, she said, “What Mr. Icahn is asking…is not quite possible.”

McDonald’s added that it “care about the health and well-being of the animals in our supply chain and has long led the industry with our animal welfare commitments.”

Hypocrisy on Wall Street

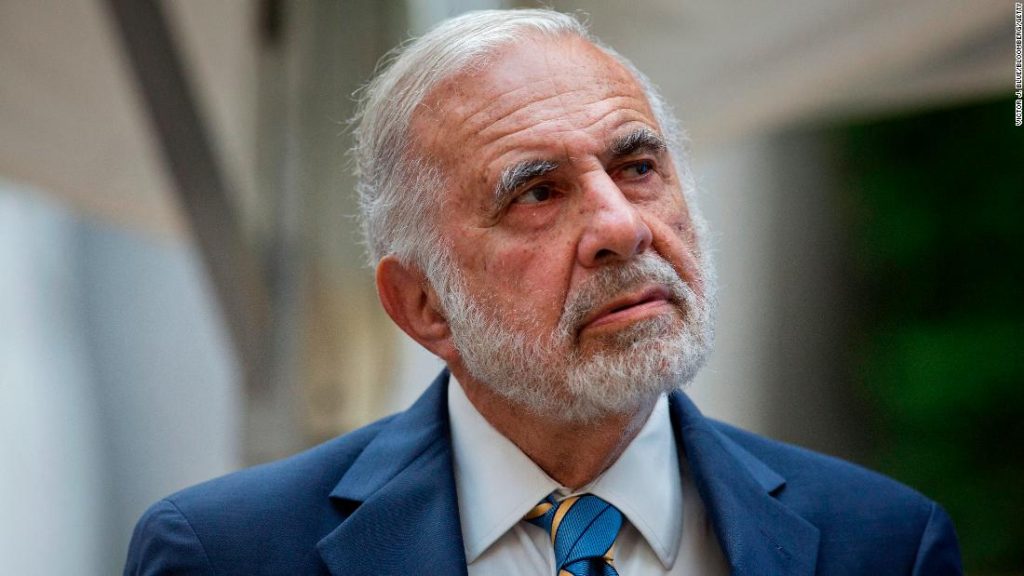

For Icahn, this isn’t just about pigs. his fight Also about Wall Street’s overall commitment to sustainable practices.

“I want to shed light on what may be the greatest hypocrisy of our time,” wrote Icahn. “It appears that a significant number of Wall Street companies, their bankers, and their attorneys are taking advantage of ESG to make profits without doing nearly enough to support tangible societal progress…It is clear that ESG’s status quo on Wall Street needs to change.”

“If the ESG movement is to be more than a marketing concept and fundraising tool, the massive asset managers who are among the biggest owners of McDonald’s must back their words with action,” he added.

McDonald’s annual shareholder meeting is scheduled for May 26. It will announce its earnings next week, on April 28.

CNN Business’s Julia Horowitz and Alicia Wallace contributed to this report.

“Twitter practitioner. Beer evangelist. Freelance gamer. Introvert. Bacon aficionado. Webaholic.”

More Stories

Asian stocks slide as Fed hike fears push Wall Street into a bear market

Dow Jones plunges 900 points, S&P enters bear market as inflation fears escalate

Bitcoin Price: Percentage Trading Paused, Binance Pausing Some Withdrawals