The risks of rising stagflation in the United States and Europe increase the potential for a “lost decade” of the 60/40 portfolio mix of stocks and bonds, which has historically been viewed as a reliable investment option for those with a moderate risk appetite.

This “lost decade” is defined as an extended period of weak real returns, says Goldman Sachs Group Inc. GS,

Portfolio strategist Christian Müller-Glesman and colleagues Cecilia Mariotti and Andrea Ferrario. Since the start of 2022, 60/40 portfolios in the United States and Europe have fallen by more than 10% in real terms, they wrote in a note released on Friday.

The risks of slowing growth in addition to inflation are amplified by Russia’s invasion of Ukraine, and already affecting many investors. The three major US stock indexes are down 5% to 12% this year, with the tech-heavy Nasdaq Composite COMP drop more. Meanwhile, bonds are also going through a tough time – with the 10-year Treasuries TMUBMUSD10Y,

Putting in the worst year-over-year performance since 2013 as of Thursday, pushing the yield above 2.1%. This underperformed the allocation of 60% for stocks and 40% for bonds.

Signs of stagflation fears are evident in the price markets. 10 years Tie in the United States Inflation, a measure of inflation expectations, is at its highest level since the 1990s, according to Goldman Sachs. Meanwhile, inflation-adjusted real yields remain near their lowest levels in decades, reflecting pessimism about economic growth in the coming years. And the widely followed spread between 2- TMUBMUSD02Y,

And 10-year Treasury yields are slowly approaching inversion, usually a harbinger of a recession.

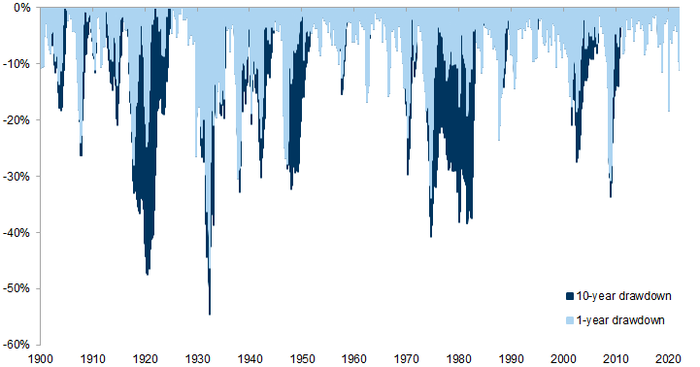

Datastream, Haver Analytics, and Goldman Sachs Global Investment Research

“The number one problem with the 60/40 portfolio is that the pace of inflation means that real returns on the bond side will be negative,” said John Silvia, founder and CEO of Dynamic Economic Strategy in Captiva Island, Florida. “And slower economic growth means slower earnings growth, which means the equity side of the portfolio is hurting as well.”

“So the overall portfolio performance is likely to be disappointing compared to past years, and could last a full decade,” Sylvia said by phone. “The reason is because you’ve had arbitrarily low interest rates for four to five years, and a lot of speculation in the market with people looking for yield. The demise of the 60/40 portfolio has been coming for a long time and it’s finally here.”

The lost decade that Goldman Sachs envisioned represents a shift from the last cycle, which took advantage of what Mueller Gillesman and colleagues call Goldilocks’ “structural system.” That’s when low inflation and real rates boosted valuations and earnings growth, despite relatively weak economic growth. Both stocks and bonds have done well side by side — with real returns on the 60/40 mix coming in roughly 7% to 8% each year over the past cycle, compared to the 5% average over the long term, they said.

The thinking behind the 60/40 mix was primarily the idea that bonds could act as a counterweight to the risks inherent in stocks. Private pension plans are one group of investors who continue to cling to the mix, and “rarely deviate from it,” according to Deutsche Bank researchers.

But lost decades are more common than many believe, according to Mueller Gillesman, Mariotti, and Ferrari. It took place during World War I, World War II, and the 1970s – in the wake of strong bull markets marked by high valuations. They said the chances of a lost decade rise in the face of stagflation.

The following chart reflects the 1-year and 10-year drawdowns in the 60/40 portfolio across contracts.

Datastream, Haver Analytics, and Goldman Sachs Global Investment Research

Goldman’s team said a range of other investments could help reduce the risk of losing another 60/40 contracts to investors. It includes provisions for “real estate assets” such as goods, real estate and infrastructure – as well as further diversification into overseas markets. Investors should also consider higher-value, higher-dividend stocks, as well as convertible bonds, according to Goldman.

To be sure, not everyone agrees with the idea of a long period of bad 60/40 returns. Thomas Salopek is a strategic analyst at JPMorgan Chase & Co. JPM Who warned in January that the 60/40 mix was “in danger,” He says he believes the US will avoid de facto stagflation and “we believe there will be no lost decade in 60/40”.

“Right now, the environment is still experiencing high growth and high inflation,” he wrote in an email to MarketWatch on Friday. With yields historically high during the Fed’s rate-raising cycle, “there is a healthy stock of bond risk premium to finally reaped as risk aversion subsides. So stocks’ outperformance should more than offset bond weakness, once risk appetite recovers.”

On Friday, Treasury yields turned mixed as investors factored in the prospects for slowing growth.

“Twitter practitioner. Beer evangelist. Freelance gamer. Introvert. Bacon aficionado. Webaholic.”

More Stories

Asian stocks slide as Fed hike fears push Wall Street into a bear market

Dow Jones plunges 900 points, S&P enters bear market as inflation fears escalate

Bitcoin Price: Percentage Trading Paused, Binance Pausing Some Withdrawals