Global stocks were hit by a new selling shock on Monday as central banks quickly curbed crisis-era stimulus measures and investors worried about signs of a slowdown in the world’s major economies.

Wall Street’s blue-chip S&P 500 was down 2.2 percent, and the technology-focused Nasdaq Composite was down 3 percent.

Europe’s regional Stoxx 600 is down 2.1 percent, while bitcoin touched its lowest point since last July.

Monday’s decline comes as investors grapple with higher interest rates from the US Federal Reserve, hyperinflation, and signs of stress in the global economy. The MSCI All-World gauge of global stocks is down more than 15 percent this year, while the Bloomberg aggregate index, which tracks the world’s fixed income markets, is down 12 percent.

“It’s hard to say if everything is low enough and low enough,” said Joost van Linders, equity analyst at Kempen Capital Management, adding that investors no longer expect the Federal Reserve to prioritize the stability of financial markets, as I did During the onset of the coronavirus pandemic.

“With [bond] Higher yields and lower stock markets, tightening financial conditions, which is what the Fed wants.”

The Federal Reserve last week raised its key interest rate by 0.5 percentage point, indicating that more big increases are looming as it tries to cool sharp inflation.

“No one knows for sure whether this will be enough to suppress inflation in the future,” said Nicholas Colas, co-founder of DataTrek Research. “This is where all the recent market volatility comes in.” Economists expect data released on Wednesday to show that US consumer prices jumped 8.1 percent in April from the same month last year.

The UK, India and Australia also raised interest rates last week. Rising interest rates profoundly change investors’ calculations when they decide how much capital to allocate toward risky assets.

The yield on the 10-year US Treasury rose above 3.2 percent on Monday before settling back to 3.12 percent, still close to its highest level since late 2018.

The US 10-year real yield, which provides a quick glimpse into the long-term returns investors can reap after inflation in ultra-low-risk securities, jumped 0.09 percentage point Monday to 0.35 percent, after starting the year at about minus 1 per cent. dollar. cent.

Concerns about higher rates have been exacerbated by indications that growth in major global economies could slow. China’s export growth fell last month to its lowest level in two years, according to data It was released on Monday following reports last week of a slowdown in Germany and France manufacturing sectors.

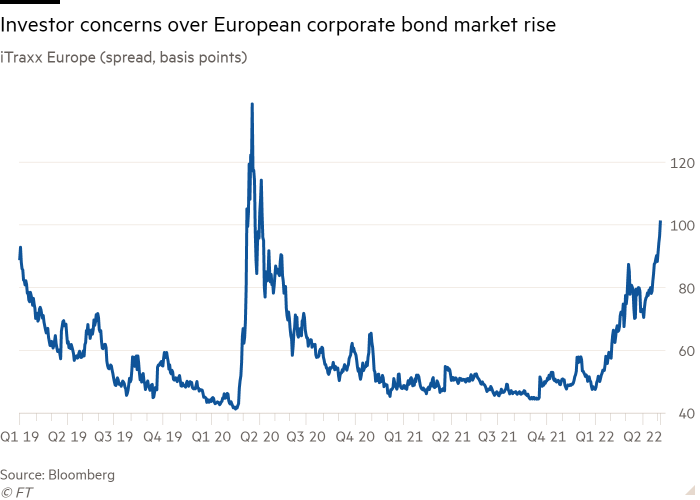

Meanwhile, a measure of the cost of default protection on European corporate bonds rose on Monday to its highest level since 2020. The iTraxx Europe Index, which tracks a basket of credit default swaps and is a barometer of investor sentiment towards risk in Europe. Markets, reached 100 basis points, up from 49 basis points at the beginning of the year.

In commodities, international oil benchmark Brent crude fell more than 2 percent to less than $110 a barrel, indicating concerns about weak demand.

“Twitter practitioner. Beer evangelist. Freelance gamer. Introvert. Bacon aficionado. Webaholic.”

More Stories

Asian stocks slide as Fed hike fears push Wall Street into a bear market

Dow Jones plunges 900 points, S&P enters bear market as inflation fears escalate

Bitcoin Price: Percentage Trading Paused, Binance Pausing Some Withdrawals