Residential madness “relaxes.”

By Wolf Richter My. S. Wolf Street.

Now there are all kinds of reports in the Canadian real estate market: # 2 The real estate bubble in the world after New Zealand – “Softening” or “slowing”. Today, Statistics Canada joins that view, with new home prices rising just 0.4% from June to July, the slowest price growth of the year, with prices in Toronto rising 0.2% and Vancouver 0.3%. Here is the meaning of the current idea of easing: prices continue to rise, but at a slightly slower pace, demand decreases and sales volume decreases. Existing home sales fell for the fourth consecutive month in July.

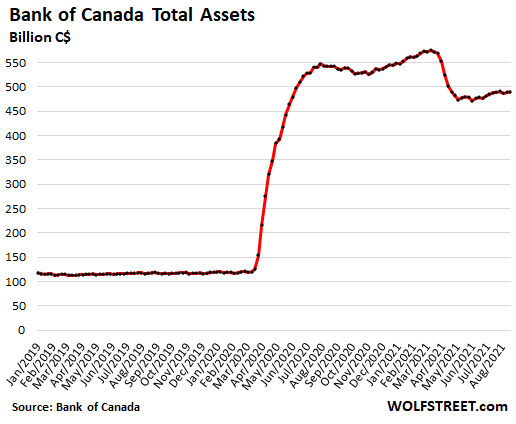

In recent months, the Bank of Canada has repeatedly pointed to the frenzy in the Canadian home market, which has created a historic rally as a result of the Bank of Canada’s crackdown on unrestricted property purchases and interest rates.

So the Bank of Canada began to cut property purchases last October. I stopped buying mortgage support bonds. I stopped buying regional bonds. It has dropped most of what Canadian repos and treasuries have had so far this year. Of the three cuts further announced, the weekly amount was reduced Government of Canada Bond Purchase, From C $ 5 billion a week last year to C $ 2 billion a week today. The overall effect is that assets on the balance sheet fell to C $ 490 billion from C $ 575 billion in March.

There may be some indications that the Bank of Canada exit is beginning to remove some fuel from the home market: the “weakening” announced by the public.

In July, Teranet-National Bank House Price Index This is an increase of 2.0% since June. That’s an even bigger jump: 24% per year! However, it rose by 2.7% in June, 2.3% in May and 2.4% in April. On an annual basis, the index continues to rise by 17.8%, the highest level ever recorded.

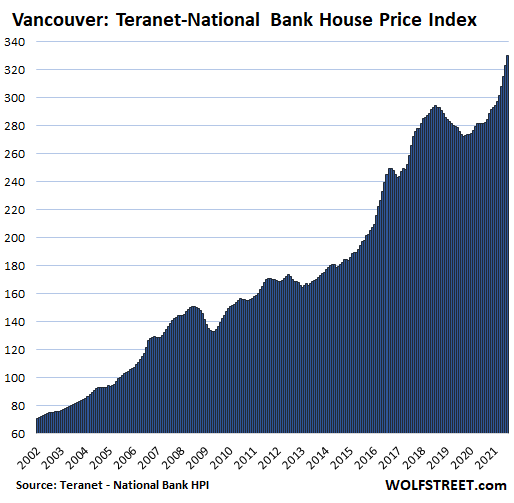

In Greater Vancouver, Home prices rose 2.1% in July, down 2.7% in June and 2.3% in May, compared to a 17.1% year-on-year increase. The Bank of Canada (POC)’s unrestricted monetary policy, which began in March 2020, worked smoothly during the Vancouver housing collapse that began in August 2018:

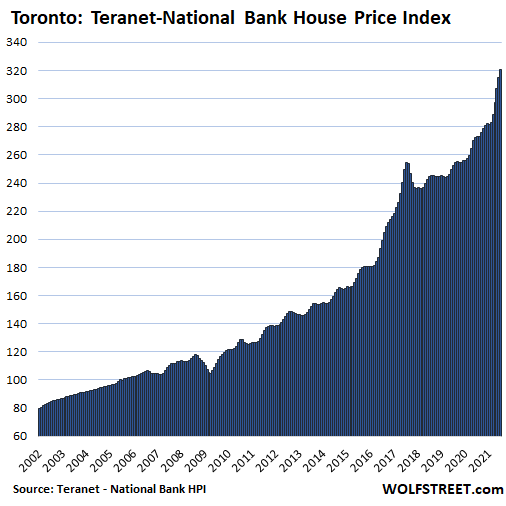

Greater Toronto areaAfter gains of 2.7%, 3.4% and 3.0% in the previous three months, inflation fell to 1.6% in June-July. On an annual basis, the index was 17.4%. Toronto saw a drop in house prices in 2017, following which a number of measures were taken until the Bank of Canada went bad:

The Teranet-National Bank House Pricing Table is usedPairs for sale‘, A similar a Case-Schiller home price index in the United States, Compared to the price of the house sold in the current month Same house When previously sold. It tracks how many extra Canadian dollars are needed to buy a single home over time, and now more Canadian dollars are needed than it was a year ago, with the Bank of Canada raising by aggressive policies to raise home prices.

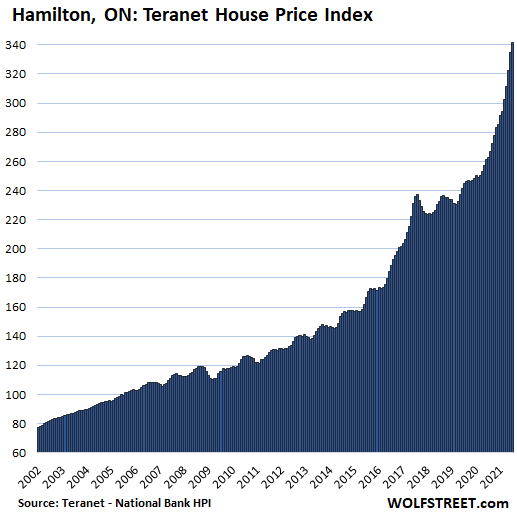

en HamiltonIn Ontario, home prices rose 2.1% in July compared to June, but rose the most since February with a 3.8% increase. The “softening” began. But year after year, the index has risen to 30.1%.

All the maps here are the same size as the Hamilton map. As we go down the list, home price increases have been lower than Hamilton for the past two decades, resulting in more vacuums above the curve.

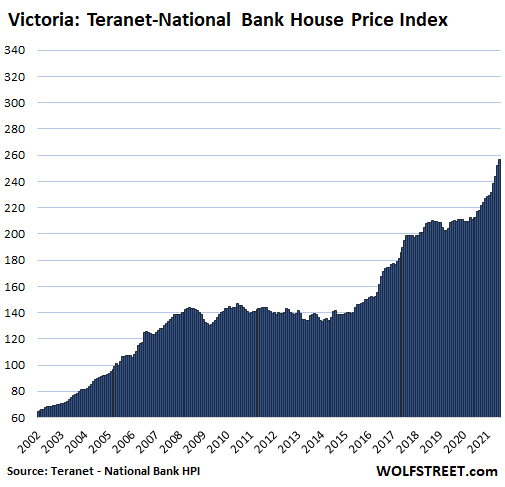

In successHome prices rose 2.1% in June, up 3.6% from the previous three months. On an annual basis, the index is up 21%. The housing market has been flat since 2018 until the Bank of Canada ceased operations in March 2018.

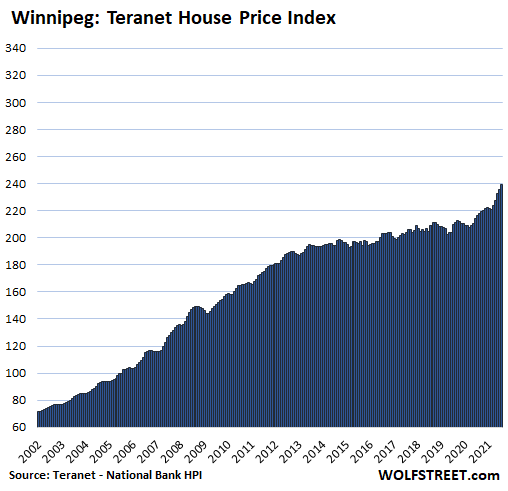

At WinnipegHome prices rose 1.6% month-on-year and 10.5% year-on-year. Housing prices have been steady since 2013 until the Bank of Canada decided to rectify this protracted situation in March last year:

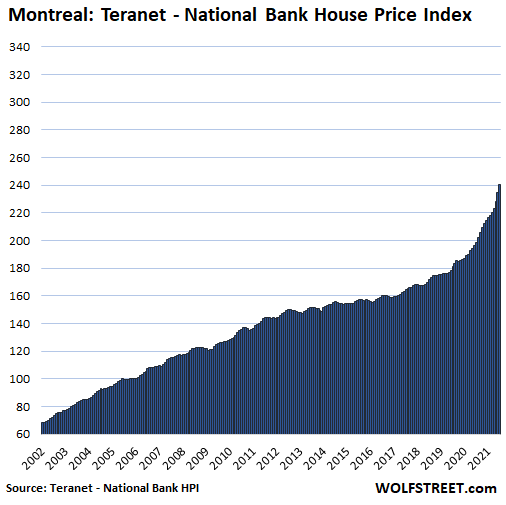

In MontrealHome prices rose 2.5% in July from 2.8% in July. The index is up 21.4% year-on-year:

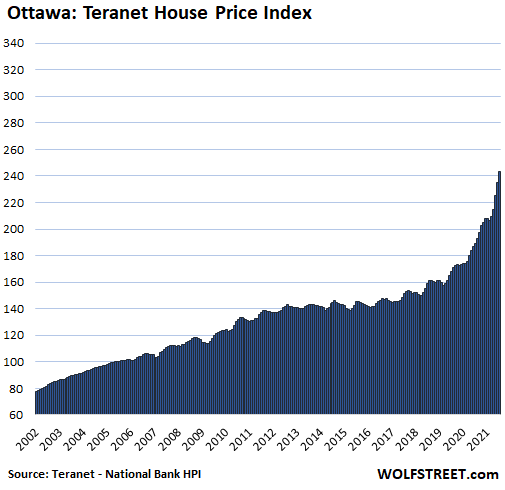

And OttawaHouse prices rose 3.7% during the month, but that was down 4.0% and 4.9% in the previous two months. On an annual basis, the index increased by 28.9%:

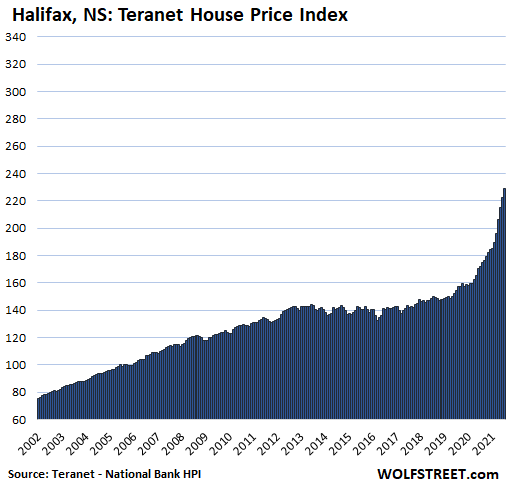

In HalifaxThe torrent index is up 3.0% this month. While that may seem crazy, it’s a brutal recession to speak from the 3.5%, 4.3% and 5.4% jumps in the previous three months. Annually, prices rise 33.4%:

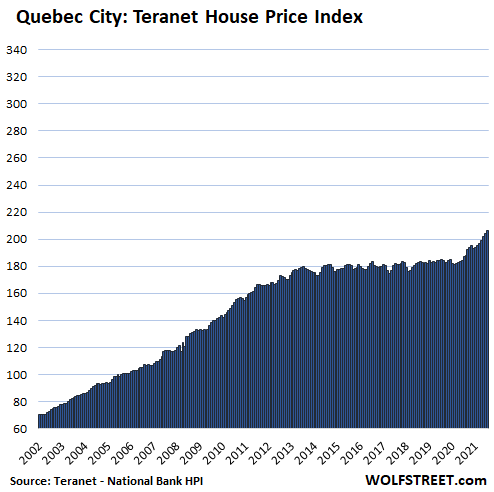

In Quebec CityHome prices rose 1.3% in July and 1.0% in July. On an annual basis, the index rose 10.3%:

In Coal and Edmonton, The cities involved in the oil crash in the Thornet-National Bank House Index and the remaining two cities are driven by the hope of rising oil prices in the past and Canadian oil zone spot wealth. But, since 2007, that oil-pumped house bubble has peaked and then burst.

In both cities, prices have risen recently. In coal, the index rose 7.5% after being hit by an oil bubble peak in 2007. Oil bubble. Since 2007. So these cities, with meaningful home prices, don’t deserve this crazy list of Canada’s best home bubbles.

Do you want to read and enjoy Wolf Street and support it? Use ad blockers, I understand why, but do you want to support the site? You can donate. I really appreciate that. Click on a glass of beer and iced tea to learn how:

Want to be notified by email when Wolf Street publishes a new article? Register here.

Check out our supporters, Classic metal roof systemsDiscuss the benefits of using the products they make.

Product information is available here Classic metal roof systemsManufacturer of beautiful metal surfaces.

“Devoted music specialist. Student. Zombie trailblazer. Internetaholic. Food geek.”

More Stories

8 Benefits of New or Replacement Windows for Your Toronto Home

Top 9 Tips on How Not to Spend Too Much at the Store

Travel Essentials for a Road Trip