Stocks fell on Friday, after a busy week that saw the market rise and then crash in quick succession, as investors focused on bad news in the latest US labor market update.

The S&P 500 fell 1.6 percent in early trading. Cursor dropped 3.6 percent Thursday after recovery 3 percent On Wednesday, it is now on track to post a fifth consecutive weekly decline. The tech-heavy Nasdaq Composite fell 1.9 percent on Friday.

Wall Street’s concern this year has been the speed with which the Federal Reserve will withdraw its support for the economy, by raising interest rates and reducing its bond holdings. These moves make risky investments less attractive, ending years of low interest rates and policies aimed at maintaining cash flow through the financial system, both of which have helped fuel a massive rally in stocks.

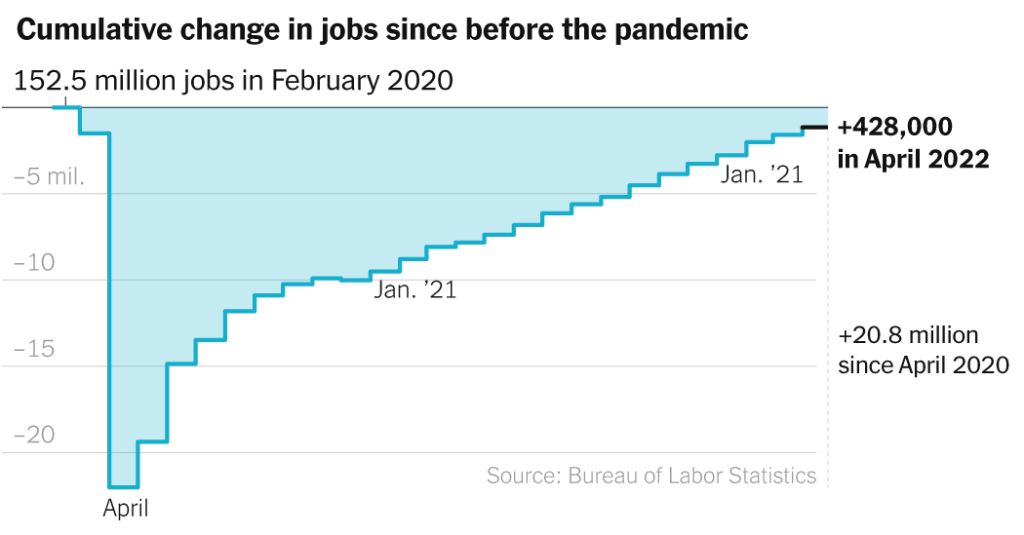

On Friday, the Ministry of Labor reported that employers have added 428,000 jobs in AprilThe average hourly wage was 5.5% higher than last year. While the report showed employment remains resilient, economists said a strong labor market and accelerating wages could prompt the central bank to raise interest rates more aggressively.

Of particular concern is that higher wages can lead to increased inflation, as companies pass on higher hiring costs to clients. This, in turn, can lead workers to demand higher wages, resulting in an upward spiral. Another worrying sign in the data is the workforce unexpectedly contracted in April.

Central Bank on Wednesday Raising interest rates by half a percentage pointt, the largest increase since 2000. Speaking after the announcement, Jerome H. Powell, Chairman of the Federal Reserve, on the labor market, and in particular Record number of job opportunities As for the number of unemployed workers, as a reason policy makers have been getting more aggressive in recent months.

You can see that the job market is unbalanced; “You can see there is a shortage of labour,” Mr. Powell said. In April, he described the labor market as “Unsustainably hot. “

The Fed is trying to slow demand by making money more expensive to borrow, but investors fear the Fed will push the economy into recession as it does.

“The April jobs data confirm Chairman Powell’s view that the labor market is unusually tight and risks an upward spiral in wage prices,” wrote Kathy Bostancik, chief US financial economist at Oxford Economics, in a note after the report.

The reaction to the jobs report was evident in the bond market as well. The yield on 10-year Treasuries, a proxy for investors’ expectations about interest rates, rose to 3.1 percent from 3 percent the day before.

“Twitter practitioner. Beer evangelist. Freelance gamer. Introvert. Bacon aficionado. Webaholic.”

More Stories

Asian stocks slide as Fed hike fears push Wall Street into a bear market

Dow Jones plunges 900 points, S&P enters bear market as inflation fears escalate

Bitcoin Price: Percentage Trading Paused, Binance Pausing Some Withdrawals