After legalizing marijuana recreational use three and a half years ago, Canada became the first G7 and G20 country to take that step. Therefore, much of the understanding of the impact of currency devaluation on the economy of a country that chooses this path comes from the results shown by the Canadian experience.

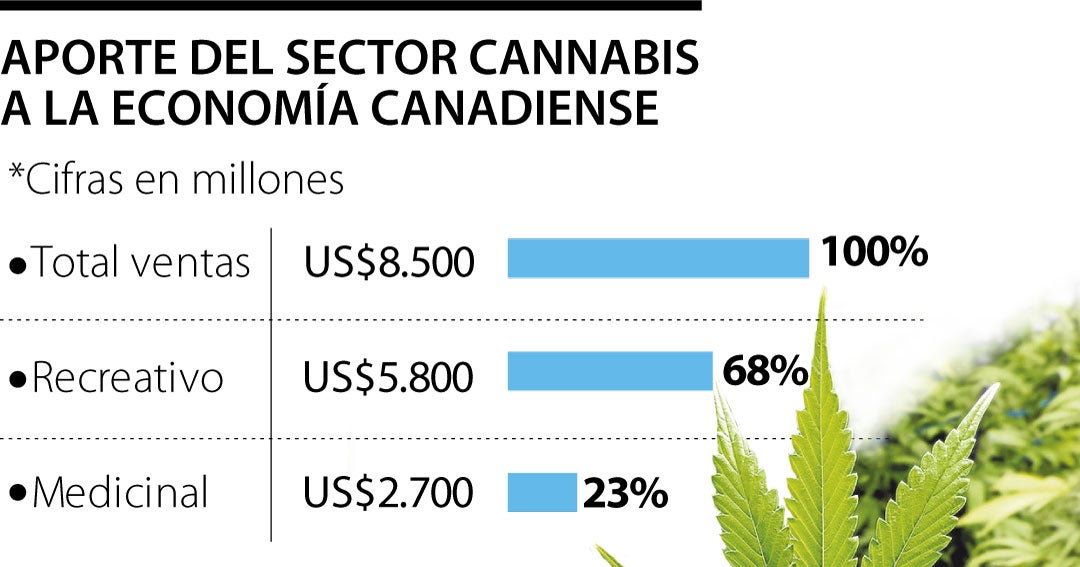

Deloitte Canada’s latest report states that from October 2018, when the legalization went into effect, until December 2021, total cannabis sales were US $ 8.5 billion. Of these, $ 5.8 billion, or 68%, is related to marijuana for recreational purposes. The remaining 32% are in the medical department. The total contribution to the Canadian economy is $ 29,000 million Canadian dollars (US $ 22,300 million), including capital investment in industry development and commercialization.And other factors that had a positive impact on GDP totaled $ 43.5 billion (US $ 33.5 billion).

“This is another way to look at the contribution to the economy: for every dollar invested in sales and capital, the industry contributes about $ 1.09 Canadian GDP. For every US $ 1 million sold, the cannabis industry supports about four jobs in Canada and Ontario.Describes the report published by Deloitte.

In terms of employment, the sector is estimated to provide 98,000 permanent jobs, a very significant number.

One of the issues that creates the greatest anticipation among countries when assessing the potential devaluation of marijuana is its potential contribution to the Treasury. In this case, the study illustrates it Federal and provincial governments have raised $ 15.1 billion ($ 11.6 billion). This figure, for more than three years, equals about 0.7% of Canadian GDP, so if that amount is divided between the current years, the average annual contribution, including taxes, would be in between. 0.2 and 0.3% of GDP.

However, it should be clarified that the contribution is growing year by year, so its weight in the collection is progressive, still in development.

In Ontario, the main province where about 40% of the Canadian population lives, the measure came into effect six months later across the country, thus being legalized for only three years in April. Most markets are concentrated in Colombia, Toronto and the capital, Ottawa. As the number of stores here increases, national statistics show further improvement.

Today, the legal distribution of recreational marijuana is almost supported 780 manufacturers are licensed to produce and market cannabis to retailers, and more than 2,700 stores nationwide serve physically directly to consumers. According to Canada’s annual survey, by 2021, 53% said they had received marijuana from legal sources, indicating an increase in migration to the formal market, and by 2020 that indicator was just over 41%.

The main argument of those who have traditionally opposed the legalization of marijuana is that consumption is at risk of increasing. At the same time, those who promote money laundering argue that the recreational cannabis industry benefits economically.

In the 2021 official cannabis survey conducted by the Canadian Department of Statistics, 25% of those surveyed said they had used it in the past 12 months, a two percentage point decrease compared to the 2020 study. It was 27%. Prior to legalization, this rate was around 22%, so despite the increase in consumption, no rapid growth was observed. This is also reflected in what happened in the market.

While it is true that the value of legal marijuana sales is significant, it is common to see cannabis companies accumulating billions in losses as more than half of the market is deducted from illicit sources because the real demand is far from over. High expectations made before legalization. By 2021, cannabis sales, along with medicine and entertainment, are estimated to be 13% of the monthly volume of unpackaged produce. This clearly shows higher supply and lower demand.

Thus, what has happened so far in Canada provides lessons that can help the debate get out of the climax and the problem can be viewed more realistically. That is, it is far from predicting rapid consumer growth and forecasting industry as the salvation of economies.

“Devoted music specialist. Student. Zombie trailblazer. Internetaholic. Food geek.”

More Stories

8 Benefits of New or Replacement Windows for Your Toronto Home

Top 9 Tips on How Not to Spend Too Much at the Store

Travel Essentials for a Road Trip